2022 Federal Poverty Guidelines Announced

The Department of Health & Human Services (“HHS”) recently announced the 2022 Federal Poverty Level (“FPL”) guidelines which, among other things, establish the FPL affordability safe harbor for purposes of the Affordable Care Act (“ACA”) employer mandate. For 2022, the FPL safe harbor is $108.83/month in the lower 48 states and DC, $136.06/ month for Alaska, and $125.17/month for Hawaii.

As a reminder, a plan can use poverty guidelines in effect within 6 months before the first day of the plan year for purposes of using an affordability safe harbor. As the FPL guidelines were announced after the start of the calendar year, plans beginning on January 1, 2022 use $103.14/month for the lower 48 states and DC ($128.85/month for Alaska and $118.68/month for Hawaii), which is 9.61% of the applicable 2021 FPL. The increased threshold of $108.83/month for the lower 48 states and DC applies to plan years beginning on or after February 1, 2022.

Background and FPL Safe Harbor

Large employers may be subject to the employer mandate penalty under the ACA if they do not offer affordable, minimum value coverage to all full-time employees and at least one full-time employee receives a subsidy in the Marketplace. For affordability purposes, a large employer satisfies the FPL safe harbor with respect to an employee for a calendar month if the employee’s required contribution for the large employer’s lowest cost self-only coverage that provides minimum value does not exceed 9.5% (as indexed)

of a monthly amount determined as the FPL for a single individual for the applicable calendar year, divided by 12.

2022 FPL Affordability Safe Harbor

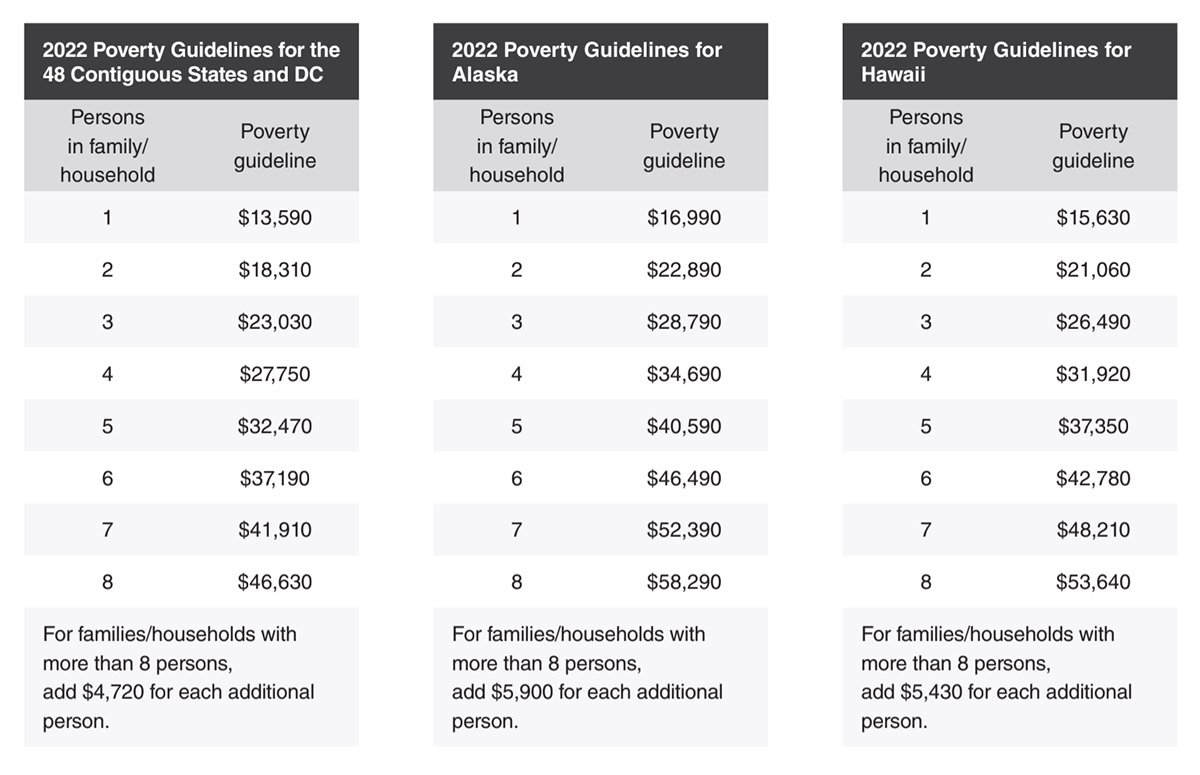

For FPL affordability safe harbor purposes, the applicable FPL is the FPL for the state in which the employee is employed. The FPL is $13,590 for a single individual for every state (and Washington D.C.) except Alaska or Hawaii. So, if the employee’s required contribution for the calendar month for the lowest cost self-only coverage that provides minimum value is $108.83 (9.61% of $13,590/12, rounded down) or less, the employer meets the FPL affordability safe harbor.